“You can wander into debt but you can’t wander out of debt.” – Dave Ramesy

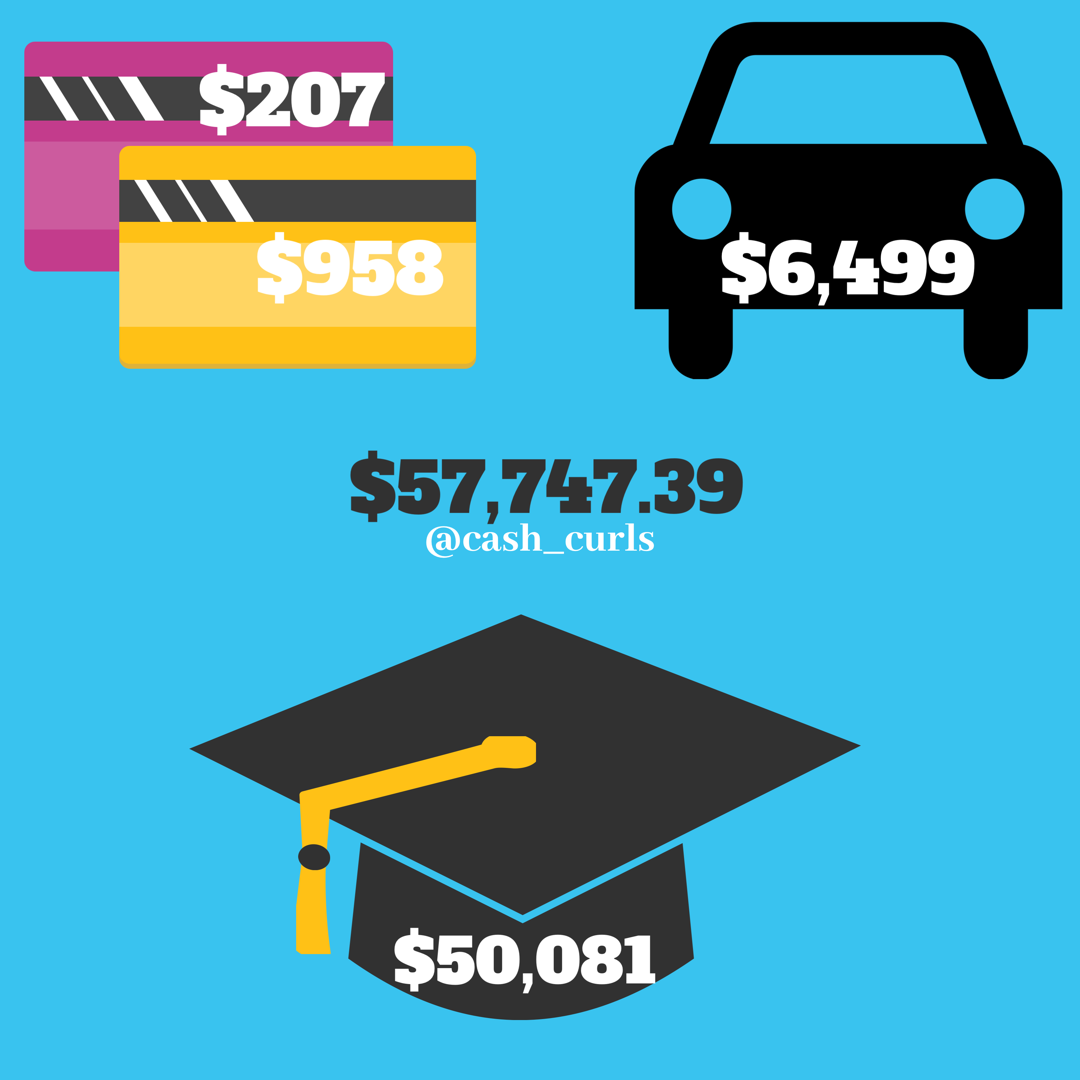

So you’re probably wondering how does a 20 year old have $57,747 worth of debt. I’m pretty sure you guessed it, majority of the debt was STUDENT LOANS!

It all started 7 years ago. I took out my first student loan in order to attend a private university that I couldn’t afford! The sad thing about it is that I didn’t even know what I was getting into. I didn’t know what debt was. I didn’t even realize that It will be my responsibility to pay the money back. I just knew that I needed money to go to school and it was taking a burden off my hands at the time. Plus everyone else took out student loans so everything was fine.

While in college, I continued to rack on debt not fully understanding what debt was. My second year of college, I got my first car and car payments started to roll in. My third year of college, I then opened two credit cards after being influenced by family and friends. By the time I graduated college, I graduated with $57,747 in debt and my dream job. YIKES!

It wasn’t until September of 2017, that I realized the amount of damage that was caused and decided to follow the Dave Ramsey’s game plan.